Latest News5 hours ago

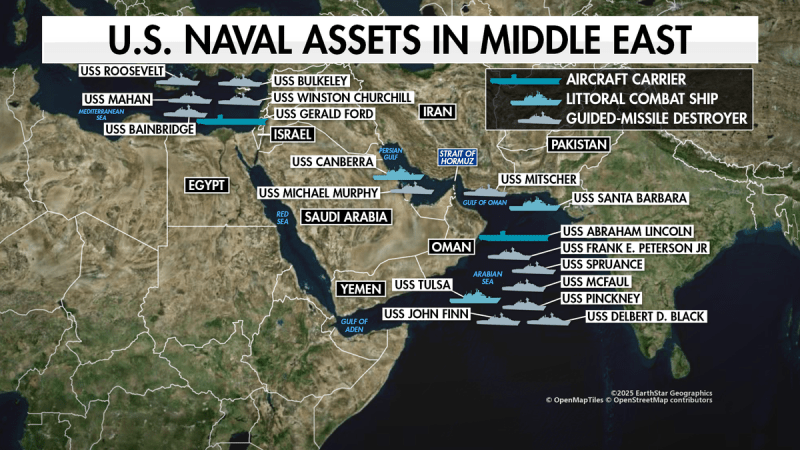

Congress weighs new funding for Trump’s Iran strikes as war costs rise and Democrats cry foul

Lawmakers on Capitol Hill could soon add another priority to their growing agenda as Republicans work to navigate a partial government shutdown and other deadlines looming in the next several

Investing5 hours ago

AI Crypto Momentum Builds: TAO and NEAR Prices Eye a Major Breakout

The post AI Crypto Momentum Builds: TAO and NEAR Prices Eye a Major Breakout appeared first on Coinpedia Fintech News AI-focused cryptocurrencies are attempting a mild recovery after facing extended

Latest NewsYesterday

State Department defends ‘proactive’ evacuation efforts against Dems’ claims of diplomatic chaos

Nearly 28,000 Americans have returned from the Middle East, according to the State Department, which outlined a large-scale evacuation effort as Senate Democrats escalated criticism over the conflict in Iran.

InvestingYesterday

Best Crypto to Buy Now: Pepeto Is the Trade Gold and BTC Cannot Deliver From Here, While Lyn Alden Says Bitcoin Beats Gold Through 2029

The post Best Crypto to Buy Now: Pepeto Is the Trade Gold and BTC Cannot Deliver From Here, While Lyn Alden Says Bitcoin Beats Gold Through 2029 appeared first on

Latest News2 days ago

Iran warns European countries will be ‘legitimate targets’ if they join conflict

An Iranian official warned that any European countries that enter the conflict against Iran will become ‘legitimate targets’ for Tehran’s retaliation. Iran’s Deputy Foreign Minister Majid Takht-Ravanchi made the remark

Investing2 days ago

PI Network Price Jumps 15% as Volume Rises But $0.28 Holds the Real Answer

The post PI Network Price Jumps 15% as Volume Rises But $0.28 Holds the Real Answer appeared first on Coinpedia Fintech News The PI Network price is suddenly back on

Latest News3 days ago

Kristi Noem’s ouster sparks rare bipartisan agreement on Capitol Hill

President Donald Trump took Washington by surprise Thursday with his decision to remove Department of Homeland Security Secretary Kristi Noem, but few lawmakers on Capitol Hill questioned his decision. Though

Investing3 days ago

Crypto Is Frozen. XRP Is Not. The Man Who Built Ripple’s Products Explains Why

The post Crypto Is Frozen. XRP Is Not. The Man Who Built Ripple’s Products Explains Why appeared first on Coinpedia Fintech News It is one of the oldest questions in

Economy3 days ago

United Airlines says it will boot passengers who refuse to use headphones on planes

Listen up, flyers: United Airlines said it will start removing passengers from flights who refuse to wear headphones while listening to content on their personal devices, and such behavior could

Investing4 days ago

Chainlink Price Gains Attention After Visa e-HKD Pilot and LINK Chart Signals Possible Breakout

The post Chainlink Price Gains Attention After Visa e-HKD Pilot and LINK Chart Signals Possible Breakout appeared first on Coinpedia Fintech News The Chainlink price is suddenly back in the

Opinion

Trending

Investing5 days ago

Best Crypto to Buy Now Ahead of the Bull Run: Pepeto Is Exploding as Ethereum Flashes Accumulation Signals

The post Best Crypto to Buy Now Ahead of the Bull Run: Pepeto Is Exploding as Ethereum Flashes Accumulation Signals appeared first on Coinpedia Fintech News Bitcoin just outperformed the

Latest News6 days ago

Ambassador Huckabee describes ‘best option’ for Americans looking to flee Israel

U.S. Ambassador to Israel Mike Huckabee described what he believes is the ‘best option’ for Americans looking to flee Israel amid the ongoing unrest across the Middle East. Huckabee said

Investing

Stock Market News

Investing1 week ago

Tether Co-Founder: AI Agents Will Transform Stablecoins and Crypto Wallets

The post Tether Co-Founder: AI Agents Will Transform Stablecoins and Crypto Wallets appeared first on Coinpedia Fintech News The man who built the first stablecoin thinks AI agents are about

Latest News5 hours ago

Congress weighs new funding for Trump’s Iran strikes as war costs rise and Democrats cry foul

Lawmakers on Capitol Hill could soon add another priority to their growing agenda as Republicans work to navigate a partial government shutdown and other deadlines looming in the next several

Investing5 hours ago

AI Crypto Momentum Builds: TAO and NEAR Prices Eye a Major Breakout

The post AI Crypto Momentum Builds: TAO and NEAR Prices Eye a Major Breakout appeared first on Coinpedia Fintech News AI-focused cryptocurrencies are attempting a mild recovery after facing extended

Latest NewsYesterday

State Department defends ‘proactive’ evacuation efforts against Dems’ claims of diplomatic chaos

Nearly 28,000 Americans have returned from the Middle East, according to the State Department, which outlined a large-scale evacuation effort as Senate Democrats escalated criticism over the conflict in Iran.

Latest News1 week ago

Supreme Court blocks Trump tariffs—but hands him a smarter path forward

President Donald Trump has lost his tariff case in the Supreme Court. However, with careful and prudent use of the tariff powers he does have, he can turn this into

Investing1 week ago

XRP Price News Today: Lightning Network Crosses $1 Billion, but Pepeto Outperforms Ripple and Bitcoin

The post XRP Price News Today: Lightning Network Crosses $1 Billion, but Pepeto Outperforms Ripple and Bitcoin appeared first on Coinpedia Fintech News The Bitcoin Lightning Network just crossed $1

Stocks1 week ago

Here’s why Hang Seng Tech Index stuck in a bear market

The Hang Seng Tech Index continued its strong downward trend this week as some key Chinese technology companies published weak financial results and as mainland Chinese investors continued selling Hong

Trending

Latest News1 week ago

Thune calls out ‘two Americas’ as Democrats refuse to stand for war heroes, law enforcement at SOTU

The top Senate Republican said the congressional Democrats’ actions during President Donald Trump’s State of the Union showed a jarring disconnect from reality. As Trump moved through his record-breaking speech,

Stay Informed With the Latest & Most Important Investing News

Popular

Investing2 weeks ago

Ripple’s Hidden Power Play: Could XRP Be the Backbone of Instant Global Payments?

The post Ripple’s Hidden Power Play: Could XRP Be the Backbone of Instant Global Payments? appeared first on Coinpedia Fintech News Ripple has always said it wants to fix one